Watts Shocking: Uncovering the Hidden Gems Profiting from AI's Power Hunger

Constellation Energy's stratospheric stock rise has investors ravenous to cash in on AI's exponential appetite for energy. With the nuclear titan's unregulated plants catering to data center operators desperate for carbon-free juice, picking this low-hanging fruit seems too obvious. But digging deeper exposes a constellation of potential plays across the power ecosystem set to feel disruptive shockwaves.

Sponsor

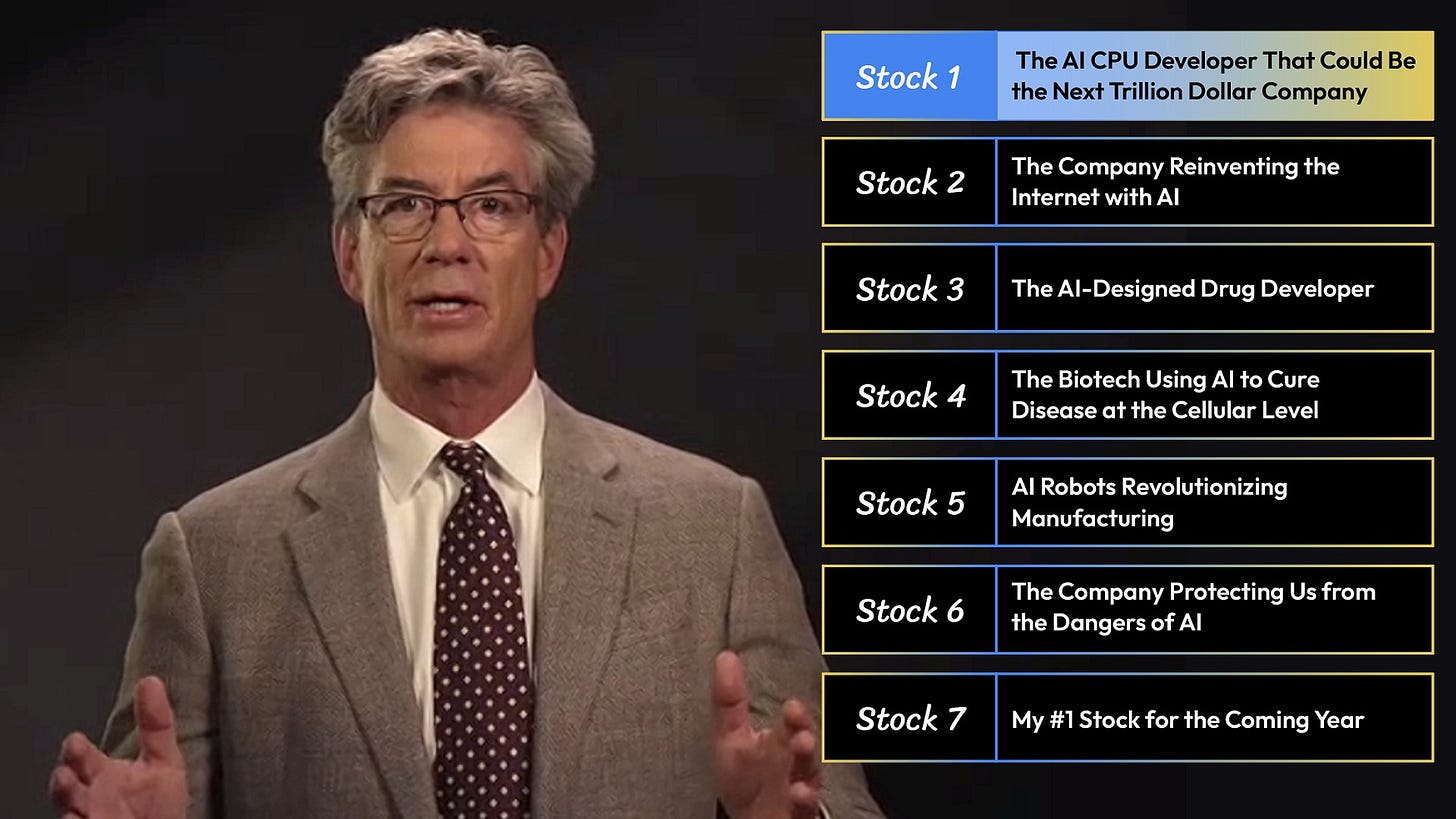

Alex’s “Next Magnificent Seven” stocks

You’re likely familiar with the original Magnificent Seven.

Google, Microsoft, Apple, Amazon, Nvidia, META, and Tesla.

These seven stocks have outperformed the market 46 to 1 over the past 20 years.

The average gain is 16,894%... turning $1,000 in each into $1.18 million.

Well… today Alex Green is releasing his new breakdown of AI’s “Next Magnificent Seven.”

These are the seven stocks he says are going to dominate the markets going forward.

In fact… Alex says $1,000 in each could turn into more than $1 million in less than six years.

Why is he making such a bold claim?

Well, let me give you a quick sneak peak at some of the stocks.

One of them, an AI CPU developer, just signed a deal with Apple to get its tech in the iPhone and iMac until 2040!

Another just signed a deal with Walmart to get its tech in every single one of Walmart’s regional distribution centers.

A third developed new internet technology that is dramaticall faster than both Amazon and Google.

I could go on and on.

But I don’t want to steal Alex’s thunder.

So please make some time to watch Alex’s “Next Magnificent Seven” presentation now.

It could have a huge impact on your portfolio going forward.

Sincerely,

Rachel Gearhart

Publisher, The Oxford Club

P.S. It’s one thing to look back on the best winners and another to find them in real time. That’s what sets Alex apart.

For example, most people only heard of Nvidia in the last couple years. Alex recommended it for the first time in 2004 when it was just $1.10 split-adjusted.

That’s why I highly recommend you pay attention to the new stocks he’s recommending now.

Watch his “Next Magnificent Seven” presentation here.

Satiating Silicon Valley's Surge

Make no mistake, AI will be an energy guzzler of historic proportions. Experts forecast data center electricity demands more than doubling by 2030 as companies like Microsoft, Amazon, and Google pour over $200 billion annually into cloud and machine learning build-outs. Morgan Stanley estimates every 1% uptick in demand could require 5-6 new nuclear reactors worth $30+ billion in fresh capital spending.

"We're entering a brave new world of computing intensity never experienced," says Shawn Hutchcroft, head of sustainability research at CFRA. "Utilities and generators providing always-on, emissions-free power for these ravenous AI workloads are the first clear winners, but the tentacles extend far and wide."

Following the Electron Trail

Investors unafraid of a little grime can profit from analyzing upstreamers mining the elemental building blocks. The International Energy Agency warns looming shortages in battery metals from lithium to cobalt, nickel, and copper imperil data center deployments. So keep an eye on innovative refiners and recyclers developing domestic supply chain resilience.

Names like Livent, MP Materials, and Redwood Materials - focused on lithium processing, rare earths, and re-use models - represent intriguing picks-and-shovels plays. So too could bargain coal miners like Peabody Energy and Arch Resources that boast hidden battery metals reservoirs ripe for harvesting.

Clean Tech's Infinite Flywheel

But the richest vein of AI-energy symbiosis may lie in advancing technologies catalyzing cleaner, denser power. Each leap in AI prowess turbocharges computational horsepower accelerating cleaner energy breakthroughs, which in turn enables even more powerful AI systems. And round the virtuous flywheel spins.

Outfits like SunPower, First Solar, and Enphase Energy innovating on solar panel efficiency stand to win big off cheaper, more abundant renewable electricity fed into AI model training. Ditto for cutting-edge plays pioneering nuclear fission and fusion, grid-scale storage, hydrogen, and carbon capture.

"The symbiotic relationship between digital brawn and clean power creates this incredible accelerant for sustainability solutions," says Sarah Hunt, associate portfolio manager at Putnam Investments. "Investing in companies riding that wave could represent the industrialist-scale wealth creation prospect of our era."

Collateral Disruptions Loom

Such seismic shifts won't be contained cleanly, however. Revenue gushers for renewable developers and new transmission backbone could leak profits from legacy utilities still burning fossil fuels. Advanced manufacturers designing ultra-efficient data center chips and cooling systems may render incumbent vendors obsolete.

sponsor

Pentagon contract could send this $2 AI stock soaring

Even commercial real estate faces tremors. Cap rate compression is inevitable as energy costs for dense server farms inflate and sustainable power sources gain new location advantages. Savvy investors, says Calvin Kim, director of energy innovations at advisory firm The Lincoln Group, should gird for whiplash.

"When you stop and think about the data terraforming from AI at scale combined with an aggressive renewable energy transition, everything from mining and supply chains to electricity markets and real estate will be massively disrupted," says Kim. "Generational winners and losers will emerge almost instantly."

Finding Truth in Brutality

For those bold enough to dissect AI's hunger for compute and the intricate web of power implications, fortunes await. But it will be a bloodbath, one demanding unflinching objectivity and iron stomach.

"That symbiotic feedback loop of AI accelerating clean power, feeding back into more powerful AI, feeding back into more advanced batteries and chips - you have to take an unbiased look under that proverbial hood," counsels Cihang Gu, portfolio manager at the NXT Insights AI Fund. "Some incumbents will brutally survive, but many are walking dead too stubborn to see disruptive forces arriving sooner than expected."

In the end, outmaneuvering the tumult requires triangulating where electrons truly flow - no simple feat when grappling with a mega-disruption radically redefining how civilization sources and consumes energy. Staid utilities and oilfield service giants suddenly find themselves crypto mining counterparts. Who could have predicted such whiplash just years ago?

The one certainty: While straightforward nuclear pure plays like Constellation offer tantalizing low-hanging fruit, unearthing the less-obvious AI+Energy victors and disruptors may reveal even greater exponential riches for the courageous. For when the world's hungriest monster is never satisfied, opportunity lurks in every crevice of the power paradigm shift.

Sponsor